New Staker role

The Tezos Paris protocol upgrade in June saw a new economic inflation/issuance model, called Adaptive Issuance. Before June in the Oxford protocol a fixed amount of tez was issued to Tezos bakers and delegators; now there is a new staker role available to delegators.

Stakers lock up Tezos (XTZ) for at least 10 days and earn twice as many rewards as delegators, but curiously delegator have been reluctant to make the switch.

The ratio of staked tez to the total supply is called the stake target.

The inflation rate in Tezos is now dynamic.

With just under 20% staked, it’s far from the desired 50% stake target so the inflation rate has been trending higher; currently at 6.92%. With so few Tezos staked this gives them a much higher yield.

You can see how inflation is affected by the amount staked by clicking (or tapping if you’re on mobile) on the chart at TezMoon Simulator.

Community voting

The Tezos community has been voting on changes to inflation with two proposals; Quebec and Qena. Quebec is proposed by the core developers at Nomadic Labs, while Qena is a community proposal that includes nearly all the same features.

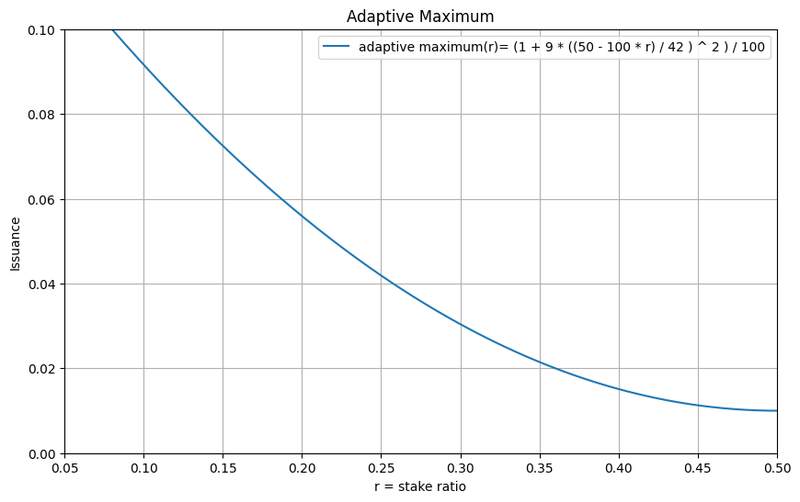

Quebec introduces an Adaptive Maximum that adjusts as the staking ratio approaches the 50% target whereas Qena excludes an adaptive maximum feature instead opting to lower the staking target from 50% to 42%.

Qena nearly won in the previous proposal round but fell short by just 2% of the 80% needed supermajority.

So back to the proposal phase we went and it’s Qena42 vs Quebec all over again. Quebec looked to be the favourite to win the proposal phase but at the 11th hour two large bakers voted in favour of Qena42. You can track the on chain governance progress at the TzKT blockchain explorer.

Leo Treasure

Leo Treasure